Chicago Booth has released its MBA Class of 2024 profile.

Few business schools in the United States have avoided the slowdown in MBA applications resulting from a buoyant job market. Put another top school in the deficit camp: The University of Chicago Booth School of Business released its 2024 full-time MBA profile over the weekend, showing applications were down 685 in 2021-2022, to 4,352, a drop of 13.6% from a school-record 5,037 applications in the previous cycle.

However, despite receiving even fewer applications, Booth School maintained the same class size for the third year in a row, at 621. Like many B schools, Booth expanded its class during the pandemic year. 2020; unlike some of his peers, Booth doesn’t appear to have any plans to reduce his class size despite returning to in-person teaching.

Booth also reports a drop in the average Graduate Management Admissions Test score from 732 to 729, with a range of scores from 600 to 780. The undergraduate grade point average remained the same at 3.60 , with a range of 2.4 to 4.0. Last year, someone with a GMAT of 590 was admitted to Booth, while another student was admitted with a GPA of 2.7. As the school states in the new profile, “There is only one standard school curriculum that leads to an MBA, right? Bad. Our MBA program attracts students from all academic backgrounds.

BOOTH JOINS MOST OF TOP U.S. B-SCHOOLS IN REPORTING DENIAL OF APPLICATIONS

In 2020-21, Booth—like 18 other top 25 B-schools in the United States—saw an increase in MBA applications; unlike most other schools, this was the third year in a row that apps had grown at Booth. But while it pushed Booth into school-record territory, at over 5,300, it was a slight 2.6% increase after attracting over 4,900 (a 10% increase) in 2019-20. — perhaps presages the downturn Booth experienced in 2021-22.

Booth isn’t alone in reporting a drop in applications, which have plummeted for full-time MBA programs across the United States. The Wharton School at the University of Pennsylvania saw a drop of 14% and the Harvard Business School of 15.4%. At Michigan Ross, the loss was 9.3%; at NYU Stern, 10%. The largest reported decline in applications occurred at UCLA Anderson, which lost 20% of its total year-over-year.

More moderate declines occurred in Duke Fuqua (6%), Georgetown McDonough (5.4%) and Virginia Darden, where they fell only 3.5%. So far, one of the top 25 B schools, Cornell Johnson, says it has increased its applications this year — and by an astonishing 21%.

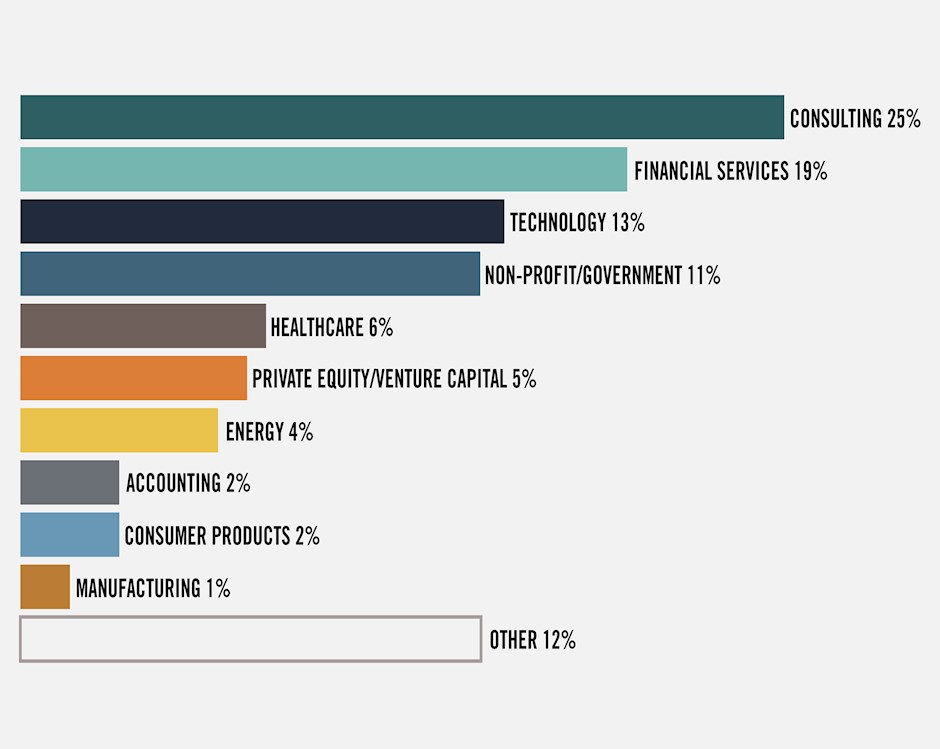

Pre-MBA Industries for the Chicago Booth MBA Class of 2024

WOMEN DECLINE BUT STILL AT 40%

In her new class profile, Booth also reports a drop in the number of women, to 40% from a school high of 42% last year. Twice before, Booth has hit 42% to slip the following year (see chart above), but at 40%, Booth remains among schools with 40% or more women, a group that last year included all the 10 best B-schools in the United States

However, Booth’s diversity was amplified by an increase this year for American minorities, to 48% from 44%, and underrepresented minorities, to 19% from 12%. The class is made up of 8% veterans and 7% LGBTQ.

Few significant changes can be found in the undergraduate majors of the new class. The class comes from 264 undergraduate institutions, up from 262 last year. Last year, 27.4% had a business degree, 23.8% an engineering degree and 23.5% an economics degree. Liberal arts (11.6%) and physical sciences (8.6%) both declined, as did the proportion of people who already had a graduate degree (16%). This year, 25% are coming to Booth with a business or economics degree and 24% with an engineering degree; liberal arts are up 13%, while physical sciences are stable at 9%. Seventeen percent of the class already have graduate degrees.

For pre-MBA industries, last year consulting led (as usual) at 23%, followed by finance (20%, plus 7% in private equity/venture capital), “other (13%), technology (12%), nonprofit/government (11%), healthcare (5%), consumer products (4%), energy (3%) and manufacturing (2 %). This year: consulting is again in the lead, at 25% of the class, and finance is second at 19% (plus 5% for PE/VC). Technicians make up 13% of the class, “others” 12%, while non-profit/government people make up 11%. Healthcare rose 6%, followed by energy (4%), accounting (2%), consumer products (2%) and manufacturing (1%).

DON’T MISS OUR STORIES ABOUT HARVARD’S MBA CLASS OF 2024 AND WHARTON’S MBA CLASS OF 2024