Harris-Stowe State University junior De’Ketra Tatum remembers listening to a lecture in February 2020 on what could happen if the coronavirus hit the United States.

A month later, she received an email saying that all students had to leave campus.

“It was terrifying,” she said. “It took a long time for me to stay calm and be able to make sure that I was able to balance my emotions in the face of the pandemic, while trying to be an academic first. “

She returned home to Memphis, Tennessee, where her father works hard to help her and her siblings go to college. She is the first of eight siblings to leave the state to study.

This summer, Tatum was among some 300 students at Harris-Stowe – a historically black university (HBCU) near downtown St. Louis – who received a call saying that student debt she had incurred during the months pandemic would be canceled.

“It has really helped my family a lot,” she said, “that way my dad doesn’t have to worry about spending so much to help me.”

Missouri’s two HBCUs – Harris Stowe and Lincoln University – are among those across the country who have come together and decided to use federal aid funds to cancel student debt. Executives found that the sales were preventing students from re-enrolling for the fall semester, and they didn’t want the pandemic to have an additional impact on the lives of their students.

“Paying for college has long been a concern for far too many of our students, but even more so as we deal with the economic problems the pandemic has caused,” said John Moseley, interim president of Lincoln University. .

At the start of the pandemic, HBCU leaders leaned on each other more than ever for advice on COVID guidelines and security, said LaTonia Collins Smith, interim president of Harris-Stowe. They shared protocols and ideas on holding classes, COVID testing, school athletics and more, she said.

From this camaraderie was born the idea of the forgiveness of loans.

“It also put us in a place where you feel like I’m not alone,” she said. “I am not the only institution having this problem or trying to find a solution to this particular problem.”

This summer, Collins Smith noticed their fall enrollments were low as some students had suffered an “insurmountable burden” during the pandemic, she said. The past year has been particularly difficult for minority communities, and many families did not plan to take on more student debt.

“We thought about: How can we best help our students to persevere? ” she said.

It was an issue other HBCUs across the country were facing as well, and leaders gathered to talk about using federal aid funds to help debt cancellation initiatives. Thanks to the three stimulus packages, Congress has paid institutions at least $ 5 billion, according to the US Department of Education.

At Wilberforce University, an HBCU in Ohio, executives announced at a graduation ceremony in May that they were paying off debts for all 2020 and 2021 graduates.

Harris-Stowe will eliminate approximately $ 330,000 in student debt resulting from the 2020-2021 academic year. On average, that’s about $ 1,076 per student.

Lincoln University, located in Jefferson City, awarded $ 1.5 million in student balances to more than 900 students.

“Our founders used the funds they had to provide the opportunity to study in 1866,” Moseley said. “We are doing the same for our students in 2021, thanks to the CARES law. “

According to data from the National Center for Education Statistics, black graduates have an average of $ 52,000 in student loan debt, which is about $ 25,000 more on average than the debt of their white counterparts.

The pandemic now offers a way to give HBCU students – who are often first-generation students from low-income families – a chance to enter their next chapter in life without the enormous debt burden, Collins said. Smith.

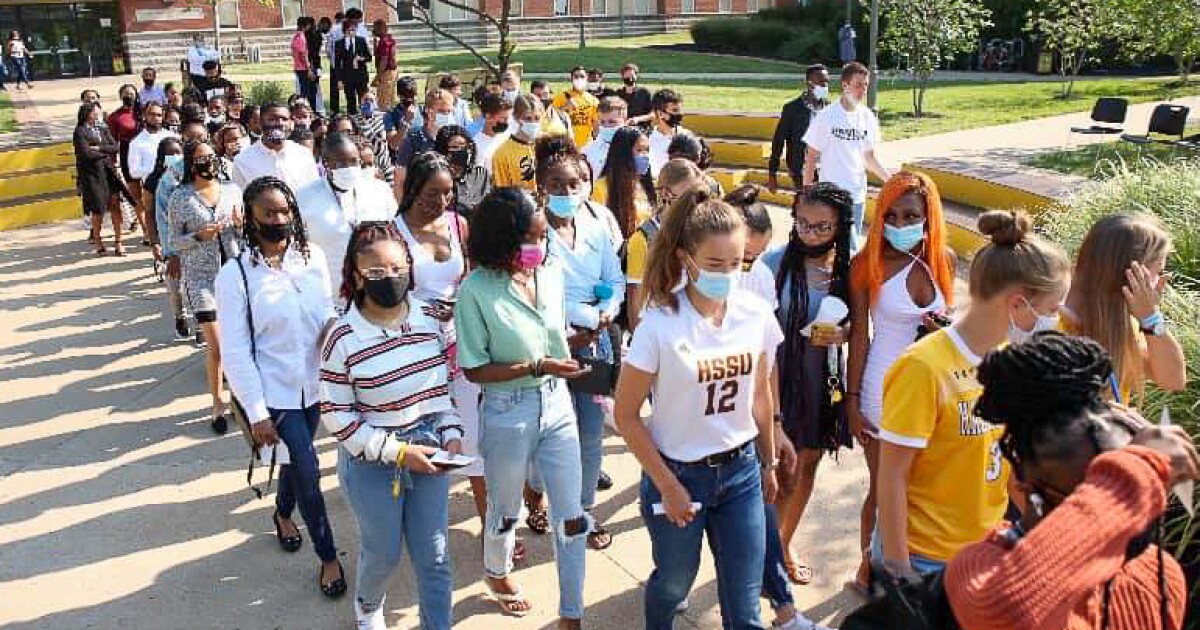

And that has certainly prompted students to re-enroll this fall, she said.

At Harris-Stowe, students did not have to ask for help. The only thing they had to do was say “yes”. Collins Smith said calls and emails to students were often met with disbelief.

“There were a lot of emails like, ‘Hey, are you serious? Is this really happening? Collins Smith said. “So just the amount of happiness and gratitude from the students for being able to have that relief, and not having to quit school, that in itself was very priceless.”